If you own a car, the annual automobile tax you must pay varies depending on the vehicle type and engine displacement. Calculating your tax accurately is essential for efficient financial management. Using a car tax calculator, you can easily determine your exact tax amount.

From how to use the car tax calculator to the latest updates for 2025, learn everything you need to know.

1. What is automobile tax?

Automobile tax is an annual tax levied by local governments on vehicle owners. This tax is calculated based on various factors, including:.

- Engine displacement (CC)

- Vehicle year

- Period of ownership

Motor vehicle taxes are used to fund road maintenance and transportation infrastructure improvements, and all vehicle owners are required to pay this tax annually. Therefore, understanding your exact tax amount helps you fulfill your legal obligations and manage your budget efficiently.

2. How to use the automobile tax calculator

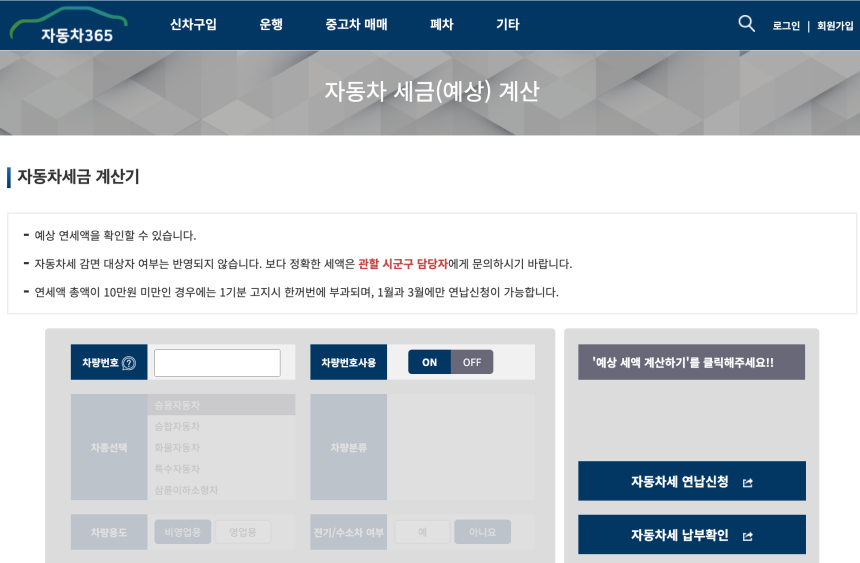

The car tax calculator is easy to use by following these steps:.

1) Check vehicle information

- Vehicle year

- Vehicle type (passenger car, truck, etc.)

- Engine displacement (cc)

- Registration date

2) Enter information

Enter the above information into the car tax calculator.

3) Calculate

‘Calculate your car tax’ When you click the button, the estimated tax amount will be automatically displayed.

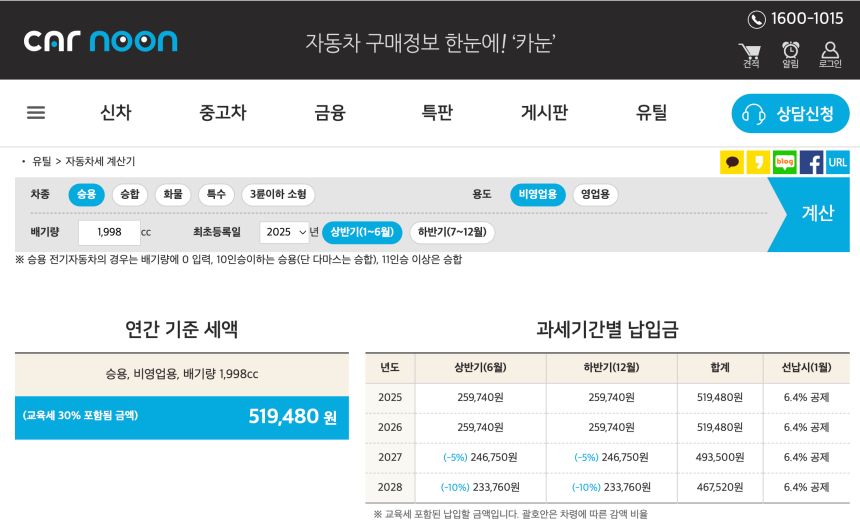

3. Information provided by the automobile tax calculator

The car tax calculator not only provides your annual tax amount, but also provides:.

- Semi-annual tax amount

- Monthly tax amount

- local education tax

Therefore, the above information will help you understand your vehicle tax burden more clearly.

4. Latest information on automobile tax in 2025

There are several major changes to automobile tax policy in 2025.

- Tax benefits for electric and hybrid vehicles

As part of its eco-friendly policies, tax breaks for electric and hybrid vehicles have been significantly expanded. This is part of the government's effort to encourage sustainable transportation.

- Increase in the proportion of local education taxes

A portion of the automobile tax is used to fund local education, contributing to the development of local communities.

5. Recommended Car Tax Calculator Sites

It's crucial to use a reliable tool for accurate calculations. That's why I recommend the following car tax calculator sites:.

6. Tips for saving on car tax

1) Make a payment plan in advance

Some areas offer discounts for early or deferred payment, so we recommend checking with your local tax office.

2) Choose an eco-friendly vehicle

Electric and hybrid vehicle owners can receive significant tax breaks.

3) Optimizing the ownership period

Please be sure to check as tax rates may vary depending on the length of vehicle ownership.

In closing

Using a car tax calculator is essential for all vehicle owners. This allows you to accurately determine when your taxes are due and plan savings. Check the latest tax policies and utilize sites like Carnun and Car365 to more effectively manage your vehicle maintenance costs and taxes.