The comprehensive income tax filing period runs from May 1, 2024, to May 31, 2024. This is also the time to receive a refund for taxes already paid when reporting income for 2023. Today, we'll explore the simplest way to file your comprehensive income tax return: directly at the tax office.

Filing a comprehensive income tax return at the tax office

There are many people around me who put off filing their comprehensive income tax returns in May for various reasons, such as being busy, not knowing how to do it, or finding it easier to leave it to a tax accountant. They end up barely finishing their returns around the end of May.

today Let's learn how to easily file a comprehensive income tax return at the tax office.

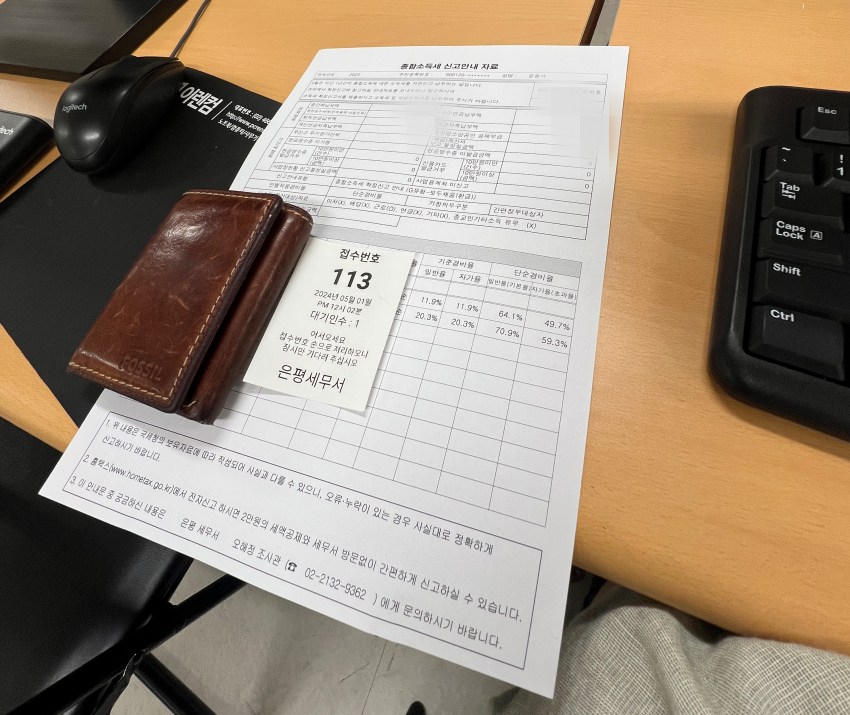

Tax offices are usually located near your place of work or residence. I visited the Eunpyeong Tax Office, which is closest to my residence.

Because the May comprehensive income tax filing period is a very important and busy period for each tax office, A service for those who visit each tax office to file income tax returns.cast It's being prepared.

- Tax Office 1st floor hall

On the first floor, we offer services for residents who file their comprehensive income tax returns directly at the tax office. This service provides tax office staff with guidance and assistance on their comprehensive income tax returns.

Take a number from the number provided next to you, wait, and when it is your turn, present your ID card at the window. Then Print comprehensive income tax information sheetAfter receiving it, go to the Comprehensive Income Tax Declaration Window on the first basement floor.

- Comprehensive income tax filing window on the first basement floor

I visited on May 1st, the first day of the comprehensive income tax filing period, so there weren't many people there yet, and it was quiet. As soon as you enter, take a number and wait. Then, you'll be seated at the computer that matches your number.

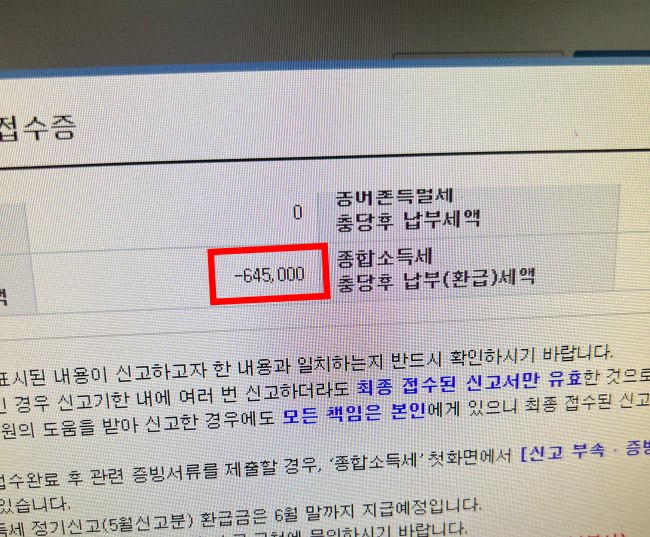

The computer I am sitting on is connected to the computer of the tax office employee, so if there is something I need to authenticate, I can simply enter it through my phone and have it verified through simple authentication. If you follow the instructions given by the tax office employee, your comprehensive income tax return will be completed in less than 10 minutes.It will work.

Since there were employees at each number in front of the computer to help with reporting one-on-one, it was convenient to be able to ask questions or check on anything right away.

After completing the comprehensive income tax return, which is like homework for May, The final refund amount is 645,000 won, and the local tax is 6,500 won, so the total comprehensive income tax is about 650,000 won.I got it back.

I was always pressed for time, barely finishing my comprehensive income tax return at the end of May. It was a relief to finally be able to easily complete it at the tax office. I encourage you to take the time to use this convenient, hassle-free service.

Precautions when using the tax office

- Bring your ID

- Reported in early May

- I remember filing last year around the end of May, and the line was so packed that I had to take a number and wait. Online filing is similar, but if you're filing at the tax office, I recommend visiting around early May to get assistance with your income tax return.

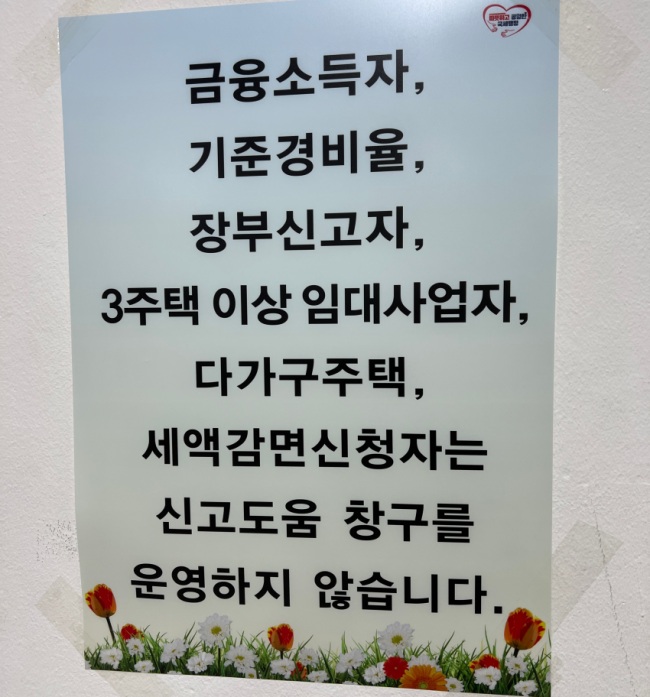

- When the reporting assistance window is unavailable

- For those with financial income, those with a standard expense ratio, those reporting on books, those who own more than three houses, those living in multi-family homes, and those who apply for tax reduction, we do not operate a reporting assistance center, so it is essential to check whether you fall under any of the above cases.

Tax Office Reviews

You can complete your comprehensive income tax return with just a few simple authentication steps. It was very convenient and the staff was there to help me one-on-one, so they answered any questions I had or needed.I could hear it right away.

Tax office reporting assistance Since I visited on the first day of service, there are still some parts of the system that are not smooth.Although there were instances where the same information had to be entered multiple times, there was hope that the reporting service would gradually become more efficient.

People who earn a lot of money will probably use a tax accountant, For those who earned a small amount of income in 2023, it is much simpler and more convenient to use the tax office.I think so.

- address : 7 Seooreung-ro, Eunpyeong-gu, Seoul

- Business hours : 9:00 AM ~ 5:00 PM

- Representative number : 02-2132-9200